2024 1040 Schedule 4 Instructions – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C .

2024 1040 Schedule 4 Instructions

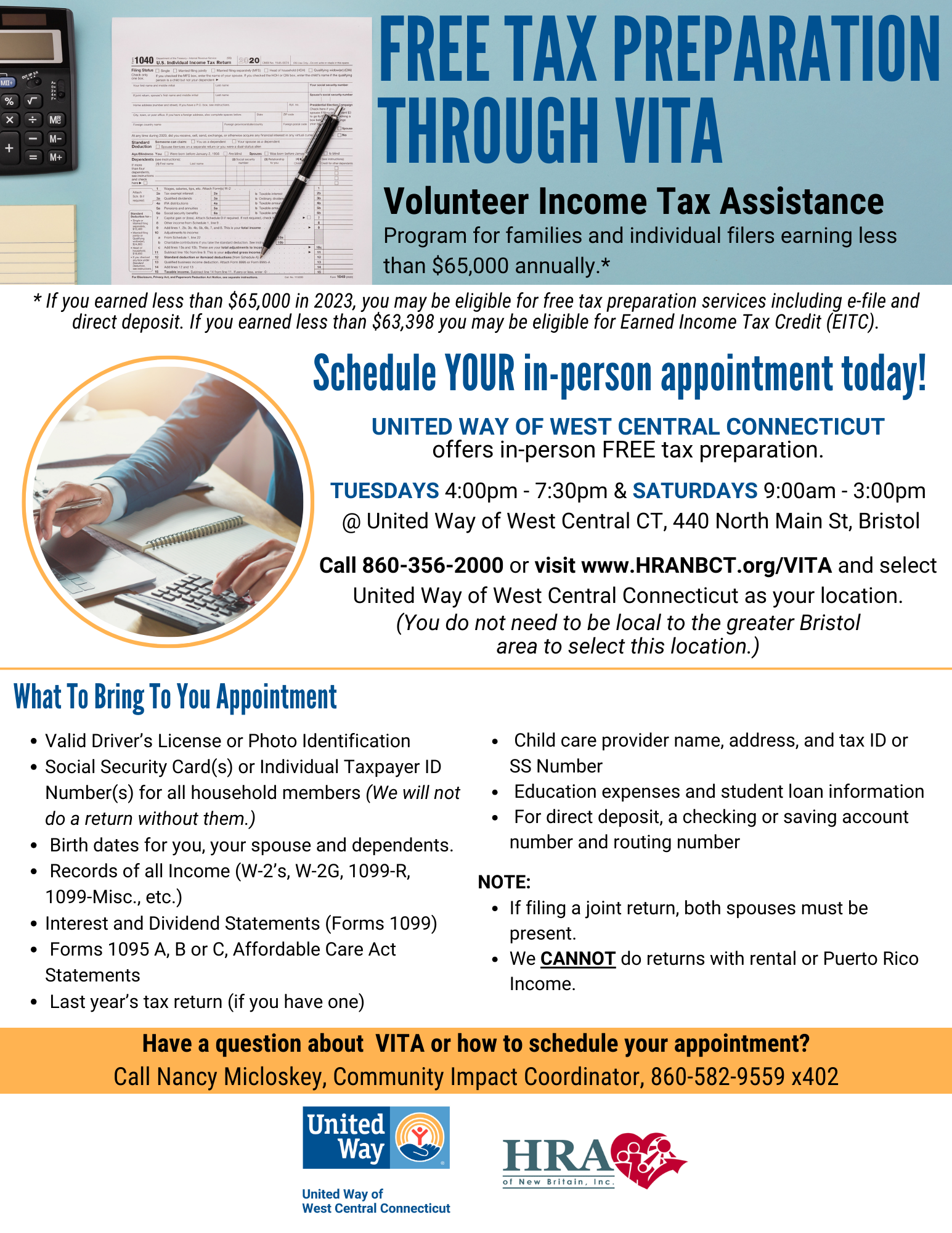

Source : www.incometaxgujarat.orgFree Tax Preparation Service | United Way of West Central Connecticut

Source : www.uwwestcentralct.orgTax season is under way. Here are some tips to navigate it. | KTLA

Source : ktla.comFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comPreparing for Tax Season PS Wealth

Source : www.pswealth.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.comTax Time FAQs 2024 – CJM Wealth Advisers

Source : www.cjmltd.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com2024 1040 Schedule 4 Instructions Form 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions : The income tax filing season will begin on Monday, Jan. 29, according to the Guam Department of Revenue and Taxation. . The Internal Revenue Service (IRS) has released the Schedule 3 tax form and instructions for the years The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)